You're at the crossroads of a divorce in Pennsylvania and your mind is spinning with anxiety and worries as you lose sleep thinking about:

- Whether or not you'll be able to afford to keep the house;

- Whether or not you'll be able to pay the bills;

- Whether or not you'll be able to get health insurance coverage;

- And whether or not you'll have enough to save for your retirement.

All of these fears are typical in a divorce (especially if you've been the dependent spouse) and they all have one thing in common:

Money.

When it comes to money and divorce, there's one issue that's more stressful, more emotional, and more difficult for couples to resolve than any other.

And that's alimony in Pennsylvania.

Coming to an agreement that will require one party to pay money to the other party to support their lifestyle after the marriage ends is challenging, to say the least.

* Note: Spousal support in PA and alimony in PA are two different things and are not used interchangeably in this article. In PA spousal support refers to the temporary financial support paid from one spouse to another while their divorce is in process (some lawyers call this alimony pendente lite.) Alimony refers to the financial support paid from one ex-spouse to another once their marriage ends and divorce is final.

Is There Alimony in PA?

If there’s one question asked over and over, it’s “Is there alimony in Pennsylvania?”

This is usually followed by…

“Why do I have to pay my ex-spouse (ex being the operative word) anything?

Our marriage has ended. And it’s time for us to go our separate ways!”

I can see why the party who is the payor of alimony in the divorce case would think this way. But let’s take a step back and look at the bigger picture. As the answer to why does Pennsylvania have alimony may surprise you.

First, it’s important to note that alimony in PA is based strictly on need and not on gender. Husbands or wives can qualify to receive it. So Pennsylvania alimony exists, in part, based on the needs of the recipient party once the marriage is over and divorce is final.

It’s a fact that two households are more expensive to run than one.

So in this case, alimony is not meant to unjustly enrich one party or penalize the other. But rather, to strike a balance between your lifestyles and allow you and your ex to live somewhat equally for a period of time post-divorce.

Second, there’s a good chance one party earns (significantly) more than the other.

Maybe you have a long-term marriage and one of you worked inside the home to raise the children and didn’t receive a paycheck for all of your excellent work. Or one of you climbed the corporate ladder faster or higher than the other, and your earnings reflect that.

Whatever the reason, alimony is intended to aid the lower-earning spouse in making the transition from married to single. To give them time to become self-sufficient and get back on their own two feet after the divorce.

And third (this is only applicable if you have children), you’re going to want your separate households and lifestyles to be similar.

This way, when the children go from house to house to spend time with each of you, there isn’t a shock to their little systems. Imagine if one of you lived in a 5 bedroom, 3 ½ bath house and one of you lived in a studio apartment.

Which home do you think the kids would rather spend time in?

There are a few things you need to recognize about the challenges of determining alimony in PA:

- The law is extremely vague on how to resolve this issue. The State of Pennsylvania provides very little in the way of guidance;

- As the Tax Cuts and Jobs Act (TCJA) eliminated the deduction of alimony payments for payors at the Federal level, and recipients are no longer required to report payments as taxable income on their Federal returns, long-standing tactics used to foster agreement are no longer useful;

- While on the surface, it might appear as if this tax change benefits the recipient and hurts the payor, it actually negatively impacts both parties;

- Further complicating matters is that alimony is considered taxable to the payee, and deductible for the payor, on Pennsylvania State tax returns;

- While inflation has cooled, the cost-of-living in PA remains elevated, and doesn't appear to be going back down anytime soon;

- Given it's significant economic and geographic diversity, where a couple lives, and plans on living, post-divorce, plays a much bigger role in determining alimony than in other states;

- This topic of alimony in Pennsylvania has less to do with guidelines or formulas and more to do with money and negotiation;

- There is more than meets the eye on this issue and this topic is much too complex (and emotional) for you to try to resolve on your own.

"While there is a guideline to determine temporary spousal support in PA, there is no such guideline to calculate alimony once your divorce is final. And if you’re thinking you can just take your spousal support number and use it as your alimony number, think again.

Instead of trying to figure it out on your own, or getting caught up in an endless loop with divorce attorneys, mediate your divorce with me.

I’ll guide you through my proven, step-by-step process and help you and your spouse negotiate and come to an agreement on alimony that's realistic and fair to both of you."

- Divorce Mediator Joe Dillon

How is alimony calculated in PA?

When it comes to child support, there's a mathematical formula that outputs a specific minimum amount a party should pay to support their children. And the formula is based on a series of clearly defined inputs.

That amount is then used as the basis for the support of the children from the day the divorce is final and forward.

But when it comes to how alimony is calculated in PA divorce cases, it's an entirely different story.

You may have heard that there is an alimony formula in Pennsylvania.

And you’d be partially correct.

But, that alimony calculation only applies to monies paid from one party to the other before you’re divorced - which is known as spousal support in PA (temporary alimony).

You see, there are times when parties live apart while still married - before their divorce is finalized. For example, say one of you gets an apartment and one if you stays in the marital home with the kids.

Because you’ve yet to negotiate the full terms of your divorce - but there are still bills to be paid - a temporary PA spousal support number is calculated to keep both households running.

But that’s where the calculation of financial support between spouses/ex-spouses in a Pennsylvania divorce ends.

Determining alimony is done using a series of 17 factors, and not by a mathematical formula.

The alimony factors in PA are:

(1) How much each of the spouses currently earn, and how much the spouses could possibly earn in the future;

(2) The ages and general overall health of each spouse from both a physical and mental standpoint;

(3) Where each spouse gets their income be it from investments, retirement savings, an insurance payout, or other sources of income;

(4) How long each party may live and if either party is expecting any inheritances;

(5) The duration of the marriage;

(6) If one spouse supported or contributed to the other receiving an advanced degree which in turn increased that party’s earning potential;

(7) If one party is home raising the children and in doing so, is either unable to work and earn enough income to cover their expenses, or if that party's expenses are higher because of their role in raising the children;

(8) The marital lifestyle the parties established while together;

(9) What the education level is for each spouse, and how long it might take for the person receiving alimony to achieve such an education level that would permit them to become more self-sufficient;

(10) What each party has in terms of assets and liabilities;

(11) What assets each spouse brought into the marriage, and which assets may still remain separate property once the divorce is final;

(12) The contributions one spouse made in keeping the marital home in order;

(13) What each party needs financially to live on post-divorce;

(14) If there was any infidelity or abuse;

(15) The tax implications of any alimony;

(16) Whether the dependent spouse (the one requesting alimony) lacks sufficient assets to provide for their own needs;

(17) If the party requesting alimony is unable to support themselves by working.

So now let me ask you a question...

What do you notice about these alimony factors in PA?

Not a single one of them results in a specific dollar amount that you and your spouse can use as the basis for your Pennsylvania alimony agreement!

Leaving you no choice but to negotiate it.

When Negotiating Alimony in a Pennsylvania Divorce, Don't Forget About Cost of Living.

As if figuring out alimony in PA wasn't hard enough, there's one more factor you need to bring into the mix.

And that's your cost of living.

Say your marital home was in Wayne, in Delaware County. And you're the one paying alimony. And your recipient spouse is moving to Quakertown in Upper Bucks County after the divorce.

There's a pretty significant difference in the cost of living between these two places!

Do you pay them based on what it cost to live in Wayne? Or do you pay them based on what it will cost to live in Quakertown?

Good question...

Or what happens if someone is thinking about moving out of state.

Given Pennsylvania's size, and proximity to six other US states, in our experience it's not unusual for one party to move out of PA, post-divorce.

For example, we've seen a Bucks County client cross the border to be closer to their job in New Jersey (a higher cost-of-living area) and a Pittsburgh client leave the Steel City to start a farm in WV (a lower cost-of-living area.)

While changes in the cost of living within the State of Pennsylvania can complicate the negotiation of alimony, relocation outside the state can as well.

How long does alimony last in PA?

Determining an amount of alimony is just one piece of a larger picture.

You also need to address how long it will last.

Which much like determining an amount, duration is not so easy to agree on.

And there’s no set formula for determining how long you have to be married to get alimony in PA.

So the answer once again is - you and your spouse will have to negotiate it.

When thinking of alimony in Pennsylvania divorce, most people think of the "check in the mail" approach.

But there are other, more creative ways to resolve this because some people just don’t like paying alimony.

For example, sometimes people will trade alimony for equitable distribution. Or do lump sum alimony or an alimony buyout. The bottom line is there’s no such thing as "typical alimony."

And there are many different ways to resolve this complex issue as I'm about to share.

But there are actually three types of alimony in Pennsylvania...

That can be awarded in a Pennsylvania divorce.

And they are:

1. Rehabilitative Alimony

This type of alimony is paid by one ex-spouse to another, for a specific purpose, and (typically) for a short period of time. It is intended to allow the recipient spouse to receive training or certification in a chosen field, in order to return to the workforce and increase their chances of becoming self-sufficient.

Rehabilitative alimony is often paid in conjunction with the second type of alimony which is:

2. Permanent (or Durational) Alimony

While the name "permanent alimony" may suggest that alimony will be paid by the payor spouse until the day either they or their ex-spouse, passes away, that's not really the case in PA anymore.

Most alimony awards in Pennsylvania now have a finite duration. It may be a certain number of years, or a defining event such as retirement, that causes the payment to terminate, and the duration to be fulfilled.

This type of alimony is paid by the higher-earning spouse to the lower-earning spouse in order to ease the transition from married to single. And allow both parties to live in a manner roughly equivalent to each other post-divorce.

3. Reimbursement Alimony

Let's say you and your soon-to-be-ex decided during the marriage that you were going to work, while she or he went to medical school (and was a dependent spouse). So you supported them while they were getting their education by paying all the household bills, their tuition bills, and generally keeping the financial ship afloat.

Now they graduated, met someone else, and want a divorce. That's where reimbursement alimony comes in.

Reimbursement alimony in PA recognizes the contribution you (or your ex-spouse) made to the household, and allows you to recover some of those expenditures.

One More Thing...

In case you're curious, yes, you can receive (or pay) more than one type of alimony in PA.

There is more than meets the eye when it comes to alimony in Pennsylvania.

As you're learning, alimony is not a one-size-fits-all topic and every couple’s situation and circumstances are unique.

So coming to a fair agreement on alimony with your soon-to-be ex-spouse requires more than just a passing conversation or a wild guess. And as you’re starting to see, there’s a lot involved in this highly complex matter.

And a lot of places you can make costly mistakes.

For example, here's a question most parties forget to ask: Is alimony taxable in PA?

And once again, the answer is it depends.

In its most basic form, yes, alimony is taxable in PA. But just like everything in a divorce, there are exceptions to this rule.

And you and your spouse can negotiate it.

In the majority of cases, the issue of alimony in Pennsylvania is much too complex and emotional for you to attempt to determine on your own.

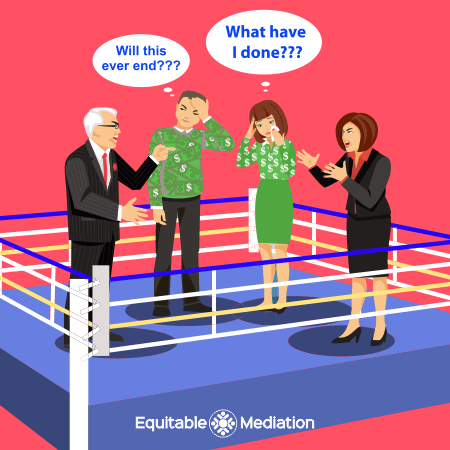

When you involve lawyers, it’s a problem.

Because there's no formula, if you go the attorney route, your family law attorneys can drag your negotiations out forever.

Because there's no formula, if you go the attorney route, your family law attorneys can drag your negotiations out forever.

Fighting and fighting. Around and around in circles - in a very gray area. All while billing you their outrageous hourly fees.

Until neither you nor your spouse has any money left to keep paying your legal fees.

And there's no money left for alimony payments!

Just one more reason it's better to not involve divorce lawyers in your negotiations.

When a judge gets involved, it’s a problem.

And if the issue cannot be resolved between the two of you and your lawyers, your case will go to court in the form of divorce litigation.

And if the issue cannot be resolved between the two of you and your lawyers, your case will go to court in the form of divorce litigation.

But there's something you need to understand here: In a litigated divorce, a judge determines the alimony factors in PA, and what the resulting alimony payment and duration will be.

Sounds scary - doesn't it?

Because they'll order the terms of the settlement and dictate what you're going to pay or receive as the alimony payment.

And you might wind up with an alimony outcome you don’t think is fair or that doesn’t meet your needs.

That’s why it’s better to negotiate an amount and duration each spouse finds fair. And negotiation is exactly what divorce mediation is all about.

In mediation, you get to decide - and come to an agreement you both agree is fair, instead of letting your future be decided by a stranger in court.

You’ll get the best PA alimony result by mediating.

Using our extensive financial knowledge into the complex matters of alimony, we'll help you determine which factors apply in your situation and discuss with both you both how they may impact the amount and/or duration of alimony in your Pennsylvania divorce.

Using our extensive financial knowledge into the complex matters of alimony, we'll help you determine which factors apply in your situation and discuss with both you both how they may impact the amount and/or duration of alimony in your Pennsylvania divorce.

We’ll actively guide you through our comprehensive budgeting process to reflect your marital as well as your projected post-marital expenses. So we can take a close look together at what each of you earns, spend, and will need to move forward.

We’ll then help you negotiate an alimony result you both find fair and will best enable you to meet your financial obligations after you're divorced.

And since we offer all-inclusive, flat-fee mediation services, we have no vested interest in prolonging the conflict because we don't bill you hourly like lawyers would.

Equitable Mediation enables you to get a fair alimony outcome.

Why be forced to accept a settlement created by a divorce attorney or family law judge in court when you can have a direct say in your financial future instead?

Why be forced to accept a settlement created by a divorce attorney or family law judge in court when you can have a direct say in your financial future instead?

If you want to arrive at an agreement on alimony that’s fair to each of you and doesn’t bankrupt you in the process, mediate your Pennsylvania divorce with Equitable Mediation.

If you and your spouse have both agreed to divorce and want to mediate, take the next step and book a strategy session for the two of you.

Other Useful Resources:

Because there's no formula, if you go the attorney route, your family law attorneys can drag your negotiations out forever.

Because there's no formula, if you go the attorney route, your family law attorneys can drag your negotiations out forever. And if the issue cannot be resolved between the two of you and your lawyers, your case will go to court in the form of divorce litigation.

And if the issue cannot be resolved between the two of you and your lawyers, your case will go to court in the form of divorce litigation. Using our extensive financial knowledge into the complex matters of alimony, we'll help you determine which factors apply in your situation and discuss with both you both how they may impact the amount and/or duration of alimony in your Pennsylvania divorce.

Using our extensive financial knowledge into the complex matters of alimony, we'll help you determine which factors apply in your situation and discuss with both you both how they may impact the amount and/or duration of alimony in your Pennsylvania divorce. Why be forced to accept a settlement created by a divorce attorney or family law judge in court when you can have a direct say in your financial future instead?

Why be forced to accept a settlement created by a divorce attorney or family law judge in court when you can have a direct say in your financial future instead?